Page 54 - E&B_septemvri 2015 ENG.indd

P. 54

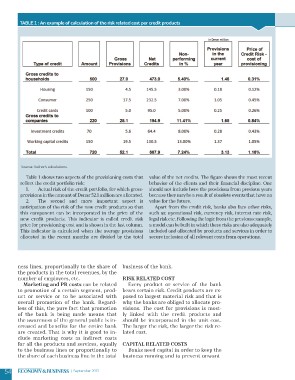

RTaUbBleR1IK: AAn example of calculation of the risk related cost per credit products

Source: Author’s calculations.

Table 1 shows two aspects of the provisioning costs that value of the net-credits. The figure shows the most recent

reflect the credit portfolio risk: behavior of the clients and their financial discipline. One

should not include here the provisions from previous years

1. Actual risk of the credit portfolio, for which gross- because they may be a result of obsolete events that have no

provisions in the amount of Denar 52.1 million are allocated. value for the future.

2. The second and more important aspect is Apart from the credit risk, banks also face other risks,

anticipation of the risk of the new credit products so that such as: operational risk, currency risk, interest rate risk,

this component can be incorporated in the price of the legal risk etc. Following the logic from the previous example,

new credit products. This indicator is called credit risk a model can be built in which these risks are also adequately

price for provisioning cost and is shown in the last column. included and allocated by products and services in order to

This indicator is calculated when the average provisions secure inclusion of all relevant costs from operations.

allocated in the recent months are divided by the total

ness lines, proportionally to the share of business of the bank.

the products in the total revenues, by the

number of employees, etc. risk related cost

Every product or service of the bank

Marketing and PR costs can be related

to promotion of a certain segment, prod- bears certain risk. Credit products are ex-

uct or service or to be associated with posed to largest material risk and that is

overall promotion of the bank. Regard- why the banks are obliged to allocate pro-

less of this, the pure fact that promotion visions. The cost for provisions is most-

of the bank is being made means that ly linked with the credit products and

the awareness of the general public is in- should be incorporated in the unit cost.

creased and benefits for the entire bank The larger the risk, the larger the risk re-

are created. That is why it is good to in- lated cost.

clude marketing costs as indirect costs

for all the products and services, equally capital related costs

to the business lines or proportionally to Banks need capital in order to keep the

the share of each business line in the total

business running and to prevent unwant-

54 September 2015