Page 55 - Ekonomija i Biznis_oktomvri 2016.indd

P. 55

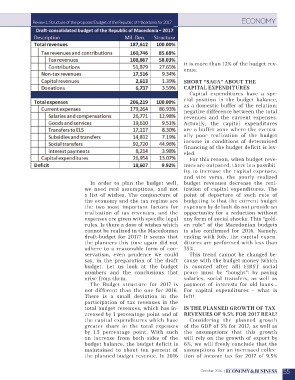

Review 1: Structure of the proposed Budget of the Republic of Macedonia for 2017 ECРУOБNРOИMКYА

it is more than 12% of the budget rev-

enue.

In order to plan the budget well, Short “saga” about the

we need real assumptions, and not capital expenditures

a list of wishes. The conjuncture of

the economy and the tax regime are Capital expenditures have a spe-

the two most important factors for cial position in the budget balance,

realization of tax revenues, and the as a domestic buffer of the relation:

expenses are given with specific legal negative difference between the total

rules. Is there a dose of wishes which revenues and the current expenses.

cannot be realized in the Macedonian Actually, the capital expenditures

draft-budget for 2017? It seems that are a buffer zone where the eventu-

the planners this time again did not ally poor realization of the budget

adhere to a reasonable form of con- income in conditions of determined

servatism, even prudence we could financing of the budget deficit is lev-

say, in the preparation of the draft eled.

budget. Let us look at the budget

numbers and the conclusions that For this reason, when budget reve-

arise from them. nues are outpaced, there is a possibil-

ity to increase the capital expenses,

The Budget structure for 2017 is and vice versa, the poorly realized

not different than the one for 2016. budget revenues decrease the real-

There is a small deviation in the ization of capital expenditures. The

participation of tax revenues in the point of departure of such rule of

total budget revenues, which has in- budgeting is that the current budget

creased by 1 percentage point and of expenses by default do not provide an

the capital expenditures which have opportunity for a reduction without

greater share in the total expenses any form of social shocks. This “gold-

by 1.5 percentage point. With such en rule” of the Macedonian budgets

an increase from both sides of the is also confirmed for 2016. Namely,

budget balance, the budget deficit is ending with July, the capital expen-

maintained to about ten percent of ditures are performed with less than

the planned budget revenue. In 2016 35%.

This trend cannot be changed be-

cause with the budget money (which

is counted after all) FIRST social

peace must be “bought”: by paying

salaries, social transfers, as well as

payment of interests for old loans…

For capital expenditures – what is

left!

Is the planned growth of tax

revenues of 9.5% for 2017 real?

Considering the planned growth

of the GDP of 3% for 2017, as well as

the assumptions that this growth

will rely on the growth of export by

6%, we will freely conclude that the

assumptions for an increased collec-

tion of income tax for 2017 of 9.5%

October 2016 55