Page 66 - Ekonomija i Biznis_septemvri 2016.indd

P. 66

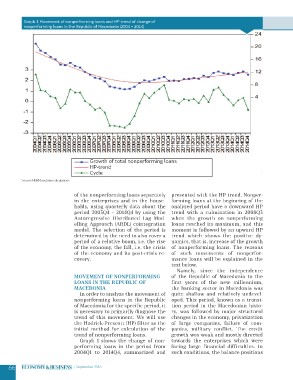

РУБРИКАGraph 1 Movement of nonperforming loans and HP trend of change of

nonperforming loans in the Republic of Macedonia (2004 – 2014)

Growth of total nonperforming loans

HP-trend

Cycle

Source: NBRM and own calculations

of the nonperforming loans separately presented with the HP trend. Nonper-

in the enterprises and in the house- forming loans at the beginning of the

holds, using quarterly data about the analyzed period have a downward HP

period 2003Q4 – 2014Q4 by using the trend with a culmination in 2008Q3

Autoregressive Distributed Lag Mod- when the growth on nonperforming

elling Approach (ARDL) cointegration loans reached its maximum, and this

model. The selection of the period is moment is followed by an upward HP

determined by the need to also cover a trend which shows the positive dy-

period of a relative boom, i.e. the rise namics, that is, increase of the growth

of the economy, the fall, i.e. the crisis of nonperforming loans. The reasons

of the economy and its post-crisis re- of such movements of nonperfor-

covery. mance loans will be explained in the

text below.

Movement of nonperforming

loans in the Republic of Namely, since the independence

Macedonia of the Republic of Macedonia to the

first years of the new millennium,

In order to analyze the movement of the banking sector in Macedonia was

nonperforming loans in the Republic quite shallow and relatively undevel-

of Macedonia for the specific period, it oped. This period, known as a transi-

is necessary to primarily diagnose the tion period in the Macedonian histo-

trend of this movement. We will use ry, was followed by major structural

the Hodrick-Prescott (HP) filter as the changes in the economy, privatization

initial method for calculation of the of large companies, failure of com-

trend of nonperforming loans. panies, military conflict. The credit

growth was weak and mostly directed

Graph 1 shows the change of non- towards the enterprises which were

performing loans in the period from facing large financial difficulties. In

2004Q1 to 2014Q4, summarized and such conditions, the balance positions

66 September 2016