Page 23 - Ekonomija i Biznis_septemvri 2016.indd

P. 23

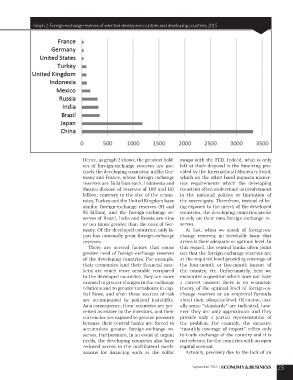

Graph 2: Foreign-exchange reserves of selected developed countries and developing countries, 2015 РУБРИКА

Hence, as graph 2 shows, the greatest hold- swaps with the FED. Indeed, what is only

ers of foreign-exchange reserves are pre- left at their disposal is the financing pro-

cisely the developing countries: unlike Ger- vided by the International Monetary Fund,

many and France, whose foreign-exchange which on the other hand imposes numer-

reserves are 36 billion each, Indonesia and ous requirements which the developing

Mexico dispose of reserves of 100 and 167 countries often understand as involvement

billion; contrary to the size of the econo- in the national politics or limitation of

mies, Turkey and the United Kingdom have the sovereignty. Therefrom, instead of be-

similar foreign-exchange reserves (91 and ing exposed to the mercy of the developed

95 billion), and the foreign-exchange re- countries, the developing countries prefer

serves of Brazil, India and Russia are nine to rely on their own foreign-exchange re-

or ten times greater than the ones of Ger- serves.

many. Of the developed countries, only Ja-

pan has unusually great foreign-exchange At last, when we speak of foreign-ex-

reserves. change reserves, an inevitable issue that

arises is their adequate or optimal level. In

There are several factors that cause this regard, the central banks often point

greater need of foreign-exchange reserves out that the foreign-exchange reserves are

of the developing countries. For example, at the required level providing coverage of

their economies (and their financial mar- the four-month or five-month import of

kets) are much more unstable compared the country, etc. Unfortunately, here we

to the developed countries, they are more encounter a question which does not have

exposed to greater changes in the exchange a correct answer: there is no economic

relations and to greater turnabouts in cap- theory of the optimal level of foreign-ex-

ital flows, and often these sources of risk change reserves or an empirical formula

are accompanied by political instability. about their adequate level. Of course, usu-

As a consequence, these countries are per- ally some “standards” are indicated, how-

ceived as riskier by the investors, and their ever they are only approximate and they

currencies are exposed to greater pressure provide only a partial representation of

because their central banks are forced to the problem. For example, the measure

accumulate greater foreign-exchange re- “monthly coverage of import” refers only

serves. Furthermore, in an event of urgent to trade exchange of the country and it is

needs, the developing countries also have not relevant for the countries with an open

reduced access to the multilateral mech- capital account.

anisms for financing such as the dollar

Actually, precisely due to the lack of an

September 2016 23