Page 47 - Ekonomija i Biznis_oktomvri 2016.indd

P. 47

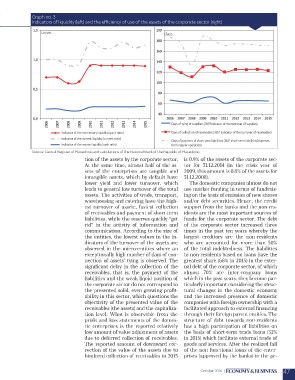

Graph no. 3 ЕКОРНУОБМРИИКЈА

Indicators of liquidity (left) and the efficiency of use of the assets of the corporate sector (right)

times days

Source: Central Register of Macedonia and calculations of the National Bank of the Republic of Macedonia

tion of the assets by the corporate sector. is 0.9% of the assets of the corporate sec-

At the same time, almost half of the as- tor for 31.12.2014 (in the crisis year of

sets of the enterprises are tangible and 2009, this amount is 0.8% of the assets for

intangible assets, which by default have 31.12.2008).

lower yield and lower turnover, which

leads to general low turnover of the total The domestic companies almost do not

assets. The activities of trade, transport, use market funding in terms of fundrais-

warehousing and catering have the high- ing on the basis of emission of new shares

est turnover of assetс, fastest collection and/or debt securities. Hence, the credit

of receivables and payment of short-term support from the banks and the non-res-

liabilities, while the reserves quickly “get idents are the most important sources of

rid” in the activity of information and funds for the corporate sector. The debt

communication. According to the size of of the corporate sector increased three

the entities, the lowest values in the in- times in the past ten years whereby the

dicators of the turnover of the assets are largest creditors are the non-residents

observed in the micro-entities where an who are accounted for more than 50%

exceptionally high number of days of con- of the total indebtedness. The liabilities

nection of assets’ tying is observed. The to non-residents based on loans have the

significant delay in the collection of the greatest share (66% in 2015) in the exter-

receivables, that is, the payment of the nal debt of the corporate sector, of which

liabilities and the weak liquid position of almost 70% are inter-company loans

the corporate sector do not correspond to which in the past years, they become par-

the presented solid, even growing profit- ticularly important considering the struc-

ability in this sector, which questions the tural changes in the domestic economy

objectivity of the presented value of the and the increased presence of domestic

receivables (the assets) and the capitaliza- companies with foreign ownership with a

tion level. What is observable from the facilitated approach to external financing

profit and loss statements of the domes- through their foreign parent entities. The

tic enterprises is the reported relatively structure of debt towards non-residents

low amount of value adjustment of assets has a high participation of liabilities on

due to deferred collection of receivables. the basis of short-term trade loans (32%

The reported amount of downward cor- in 2015) which facilitate external trade of

rection of the value of the assets due to goods and services. After the realized fall

hindered collection of receivables in 2015 of the non-functional loans of the enter-

prises (approved by the banks) in the pe-

October 2016 47